The global chip shortage has everyone worried and suddenly more interested in the back-end of Supply Chains, and specifically, a company in Taiwan called TSMC (Taiwan Semiconductor Manufacturing Company). Right next to this fire ablaze, is the powder keg that is the US-China relationship currently at its nadir. Since the Nixon administration, the United States has adhered to the One China policy, while providing tacit military support to Taiwan, while maintaining ties. Given the stupendous growth in the last couple of years, TSMC has also become a massive strategic asset as their biggest buyers are in China and the US.

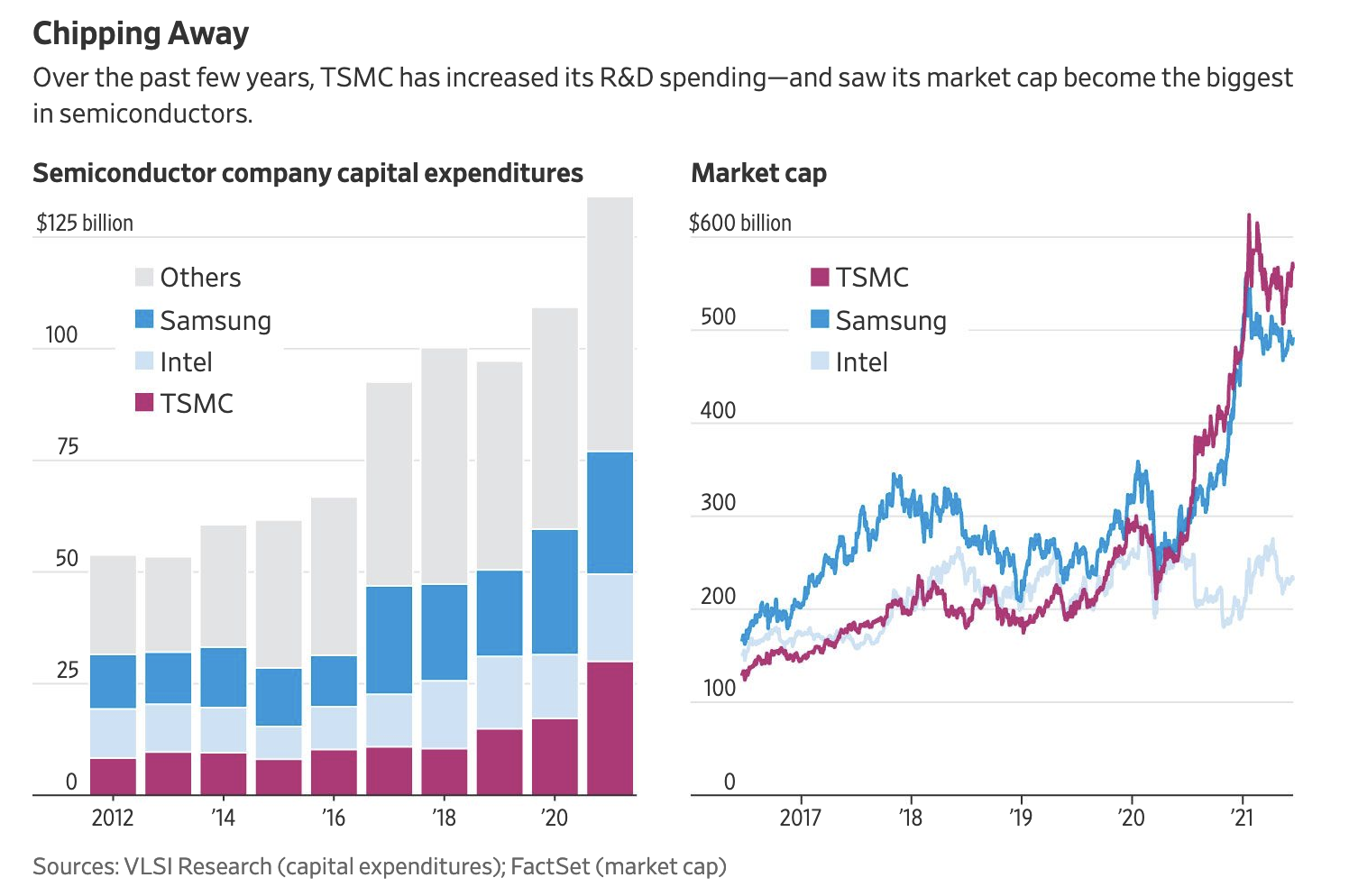

Looking at the figure above, you can see the accelerating capital expenditure of TSMC, which has also accompanied an explosive growth in Market share. TSMC has also overtaken Intel in many significant ways, but most importantly, in capability. (Arizona recently has been encouraging TSMC to set up a $12B fab plant. I wrote about it here on the blog. Arizona plant will be making 5-nanometer tech chips, while the industry is moving to 3-nanometer chips. Echoes of Foxconn Wisconsin here).

Humble Beginnings

The founding of TSMC itself is an interesting story. I always love a story of engineers and businesses, so here it goes.

The founder of TSMC, Morris Chang, was an executive at Texas Instruments (TI) for twenty-plus years. Mr. Chang earned an undergrad and a master’s degree in Mechanical engineering at MIT — a fellow mechanical engineer! TI even sponsored his Ph.D. in engineering at Stanford paying him his full salary. After six years of heading their fledgling semiconductor line of business, he was expected to be promoted to the C-suite. But, of course, at this point, strange things happened. Actually, not very strange, as CEOs then tended to be cut from the same cloth. Mr. Chang was, in his own words, “put out to pasture”, by being made junior staff in another losing consumer business line.

Aside: So far, this is very much like the story of Vyomesh “VJ” Joshi, who ran Hewlett Packard’s successful printer division, but always passed over for characters (see Carly Fiorina, Mark Hurd, and Meg Whitman) that have led HP as its CEO.

Anyway at the age of 52 — when many would retire and take up golfing — Mr. Chang founded TSMC.

Value Chain: Moving from Cost to Capability.

TSMC’s proposition to vertically integrated companies was simple: Let us take care of the production and manufacturing, and you can focus on the design. People (still) think of fab production as “low end” and design as “high end”. AMD, one of the earliest companies to sell its fab plants and outsource the fab production to TSMC. The primary reason to do such outsourcing is, of course, low cost.

Many US companies increasingly premised their competence on design and outsourced manufacturing now with the emergence of Apple and Qualcomm, this idea is quite old. In fact, Apple proudly proclaims “designed in California”, but their phone processer chips are exclusively manufactured by TSMC. TSMC is their biggest supplier, and Apple is TSMC’s biggest buyer. But such outsourcing came with a hidden cost.

Many view production as “low end” work, but knowledge flows upstream.

A lot of engineering and process knowledge critical to the middle management is accrued through “learning by doing”. There was certainly a lot of “doing” at TSMC. All the while, no one paid attention to all the learning that was happening at the TSMC.

During all these production runs and increasing manufacturing scale, their capability was getting better. In the midst of all this Mr. Chang, now 89, made an early bet on extreme ultraviolet lithography. Along with Samsung (see chart above again), TSMC is now a world leader in the segment of ultraviolet lithography. (More on their upstream acquisitions such as ASML later on this blog).

Auto Supply Chain Bullwhip

The extreme shortage of auto supply chains has a simple connection to all of the above. The “low quality” auto chips are less than 5% of TSMC’s revenues. When covid hit, automakers dialed back their production, and probably canceled orders. While running at full speed capacity due to post-covid explosion in home computing division and phones, TSMC probably had its capacity reallocated to more profitable lines of business. Now when recovery is happening, there is just not enough capacity available for the automakers.